How the Investor Fintech Dynamics are Mutating?

Fintech being the cocktail of Finance and Technology has taken the entire world by spin. Where the VCs and Investment Firms used to be solely focused on Technology companies only, Fintech has become the new goldmine for them. From Digital Payment companies to Microfinance and small to micro-lending companies have become the cynosure of the entire investor community and special attention has been grabbed by the African region due to their meteoric rise in the fintech domain.

Africa – The New Frontier for Fintech:

For the past six years, the sector has been the continent’s most populous and heavily funded tech start-up zone, with companies raising nearly $ 900 million over that period, according to Disrupt Africa, a website that tracks startups.

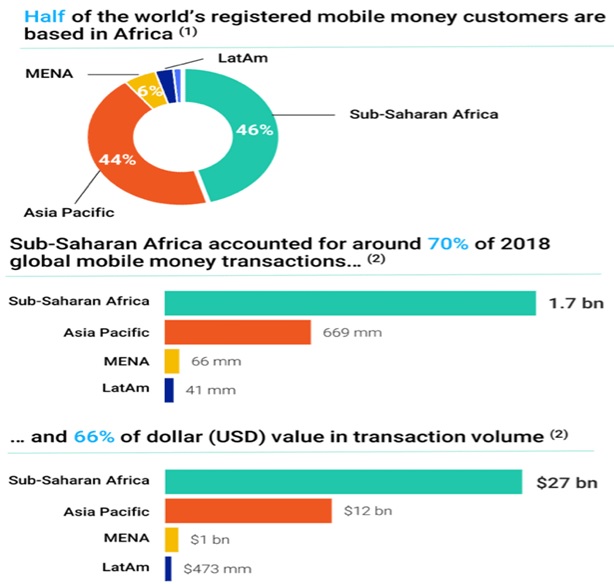

The population of Africa is likely to continue to take advantage of the region’s growing cellular and internet penetration and embrace the emerging digital payment, banking, insurance, and credit services. Therefore, we can easily and accurately speculate that Africa’s demand for financial services, especially since the population remains largely without bank details and at the same time is the second-largest banking and payments market with the fastest growing world market, will soon bypass traditional banking systems. It encompasses almost two-thirds of transaction volume by value.

Despite this success, challenges persist in using the tool in new and innovative ways: the persistently low prevalence of cellular networks and the Internet, particularly in rural Africa, suggests that there is a huge scope of improvement.

Across the geography, fintech organizations are changing the ballgame of traditional banking and financial services and coming up with new ideas backed by heavy funding and completely revolutionized infrastructure. Initially, they focused their activities on specialized areas such as payments, credit insurance, and investment, but now they are trying to scale with different services.

Numbers that speak volumes

Based on a new report by Disrupt Africa, which has been tracking African fintech startups since 2015 and has published reports every two years since then, Disrupt Africa defines fintech startups as those that disrupt traditional financial services and providers of services established in startups with a Fintech challenge solution at the core of their business. 576 startups were tracked for this report.

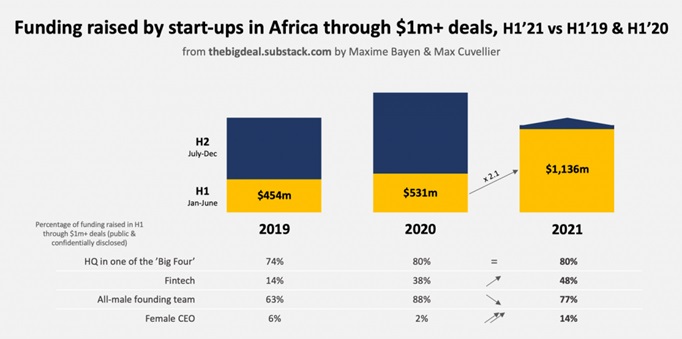

Investors from other sections of the world, who haven’t made a significant stride in giant companies, don’t want to miss the boat this time and are very proactive and supportive of the African Fintech movement. From giant corporations to venture capital firms (VC) of countless sizes, nobody wants to be left behind. In one quarter of this year alone, African fintech firms raised $ 906 million, according to Digest Africa, an early investment database on the continent, which is more than 60 % of all venture capital flows into Africa in the last quarter and more than all other industries in the entire first 6 months of 2021.

This year’s trend is based on a separate analysis by BFA Global’s Catalyst Fund, which showed funding for African fintech has grown exponentially, from just $ 385 million in 2018 to 1.35 billion dollars last year. In terms of the type of services, fintech companies that specialize in digital payments dominate the fintech investment landscape in sub-Saharan Africa in terms of both financial and transaction metrics, while fintech companies that specialize in digital banking and specialized in credit services, closely followed by 40 percent lower in terms of financing as a digital payment service.

Africa’s Fintech – Investor’s Paradise for Investment

The sudden growth in numbers of the mobile financial services signifies that the strength of financial technology companies is set to completely change the paradigm and revolutionize the financial landscape in sub-Saharan Africa. For investors, demographic trends in the region such as a sizable rapidly growing population, a growing middle class, and a significantly underdeveloped financial services industry indicate the growing demand for digital financial technologies in the region. The alliances in Africa are another draw for foreign investors as prices soar in regions like the United States and Europe. Africa is not a priority because venture capitalists in the west have seen great returns, but some smaller investors may find it harder to get good returns due to recent valuations, which prompts them to look further afield.

Strategic investors who used to only look at traditional fintech companies are also looking for alternative financing models or rather a fintech enabler model. As still there is a gap regarding both business understanding and communication, alternative models as a viable option are trending quite heavily in the market and companies like Ovamba and Lendable are doing the same.

Large e-commerce groups or even business conglomerates like Sequoia Heritage, Stripe, and others have invested a staggering $200M in African fintech Wave at a $1.7B valuation. They are not shying away from taking up a slice in this burgeoning market segment. Where telecom operators and traditional banks may have been the first entrants, but companies like Wave and many more are coming up as there is a huge demand for their products and a complete and sustainable ecosystem is being built by the government for the investors to continue to cash in and continue the flow of money for fintech disruption.

Foreign investors are more willing to invest capital in the region, but many argue that many startups may be undervalued due to increased risk. Africa has only a few billion-dollar startups, and most have risen to unicorn status in recent years, like Fawry leading the pack in Egypt, a dominating digital payments provider, shortly followed by Flutterwave, Opay, & Interswitch (which was valued at $ 1 billion in 2019 after partnering with Visa), all hailing from Nigeria, and again all offering different formats of digital payments enablement, with further trailing Fintechs soon to earn their Unicorn status, however, all this comes big with high-risk withdrawals, and companies entering the market earlier can make solid profits as the ecosystem matures.

Current instances of foreign investors having an intense interest in the African region would be Japan’s Open Fund, which launched a $ 15 million vehicle in early this year specifically for supporting and launching the new and upcoming African startups while U.S. companies such as Tiger Global made sound investments in companies like the microfinance company FairMoney. Earlier this week, Valar Ventures and current investor Target Global led a $ 55 million round at challenger bank Kuda with a valuation of $ 500 million, TechCrunch reported.

The first investment in Kuda last year opened avenues to the new wave of digital companies in Africa, mentioned by Ricardo Schäfer, Partner at Target Global. Several great companies are solving real vulnerabilities and targeting huge markets. It is difficult to predict the future, but it is expected that we will see a similar influence of successful startups in Africa, which we saw 20 years ago in places like India and China.

The favorite regions and near future – what it holds!

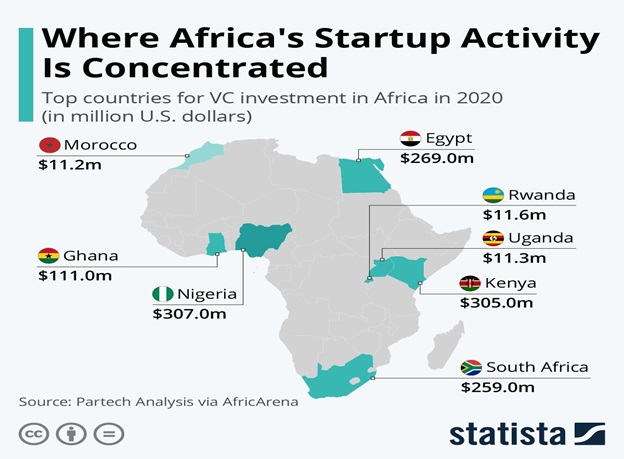

It should be noted that many of the region’s local fintech startups are based in the tech hubs of Sub-Saharan Africa: Nigeria, Nigeria, Kenya, & South Africa; however, due to the geographic concentration of fintech in Africa and their limited but growing access to finance and business size. African fintech companies are predominantly active in their home country or regionally and that Africa’s digital payment systems are accordingly highly fragmented.

Most of the funding for African fintech startups goes to companies from Nigeria, Egypt, South Africa, and Kenya. Taken together, investments in fintech startups in these countries account for 87.9% of the total amount companies in this space have raised since 2015. The three are the main funding targets as they have the newest ventures in financial technology (together 68%.) And have more developed ecosystems. They are more confident to invest in these countries than anywhere else.

Most of the investment in African fintech has gone into payments and remittances. Startups that deal with payments and remittances received the most investments. This is because this is the most established and most populous category in fintech, and it addresses a huge fundamental issue. how to get paid and paid cheaply and quickly. Additionally, there are big companies with a long history in payments and remittances, and investors like companies that have proven themselves and have already attracted big investors.

Another emerging player is Open Banking, which Disrupt Africa presented for the first time. Open banking is a system that is expected to revolutionize the banking sector. It enables control of consumer bank accounts through third-party applications, enabling them to expand the reach of customers while creating a revenue-sharing system for new businesses where they can benefit from a subscription or baseline of their third-party applications.

This room is new and has few players. Disrupt Africa is tracking six, including Pngme from Nigeria and truID from South Africa. But with 1.8% of all fintech financing, this banking model has already raised more money than some older areas. Open banking is something to watch out for in the years to come, especially in Africa’s more developed fintech markets.

The Changing Dynamics of the Investor - Fintech Paradigm

With all the above being said, there is one pressing trend that has been developing in recent funding rounds with a lot of the global Fintech startups, and most certainly within Africa, that is investors, whether VCs or even a lot of the investment banks and PEs, are not only merely interested in providing cash-based capital funds but looking into creating a much more strategic leverage on their investment portfolios. This has been a growing aspect of providing non-cash based investments, whether it be resources, contact networks, lobbying, and PR, and other kinds of professional services, however, one increasingly dominant huge component is the actual technology platform these Fintech startups would use a principal cornerstone in building up their value offering and take it to market.

Today, investors are actively creating a cocktail of global partnerships with technology providers across various domains to include in their investment package to startups, in fact with some using it as conditional leverage over them. That does not come empty-handed, it is ensuring a lot of the young immature founders in many cases (which is why so many fail during the first 2 years of inception) adopt a technology platform that would provide them with sufficient agility in building their product, thus nimble enough to go to market in the fastest possible time and scalability that would make exponential growth possible, and nowadays we are talking on regional and international levels, not within the local market of the establishment.

This is not to say that whatever intellectual property the Fintech startup may bring to the table is to be disregarded, quite the contrary, they embed that with the much holistic technology that would further catapult their own technology footprint into being something of reality and see light!

The idea that investors want to position themselves as a more strategic partner to the startup rather than the classical cash machine is making all the financial sense. They minimize risks by being involved, having more control (hey in a majority of scenarios, they already are), providing a technology that would enable these Fintech startups to have all the necessary tools to create, adjust, and mold the ideal go-to-market approach and easily build up with efficient cost-effectiveness that would make them realize profitability in shorter time spans. Investors would be more engaged and involved rather than manufacturing business decisions that may not necessarily be in the best interest of the business (perhaps company value only yes), and actually, see the details of the business growth processes.

One interesting example that has directly addressed this phenomenon is the VERICASH Fintech Factory technology, which utilizes its already comprehensive digital platform, to provide a technology that enables Fintech startups (at any stage) to flexibly use it to create its idea of a product with all the different MVP services and its initial business model (integrating their already existing IP technology, if any), put it to the test and play around with configurations that are very user friendly with no need of complicated and tedious long-lasting coding and development efforts (the equivalent of a typical sandbox, you could say), then create their first prototype application, test some more, until they have their final first got to market version, and use that same platform to take it to live into production and scale up the business and easily with all the agility they need amend, add, or rebuild their product as the business evolves.

As such, VERICASH has struck several regional agreements with some of the different investor communities, partnering up with them to fulfill and preach this new trend increasingly becoming popular. The idea is that VERICASH not only provides the technology but all the support and expertise needed to be accompanied by that to help the investors operate a platform that adds a different perspective of value to many of the Fintech startups. This extends to some of the more established Fintechs, enabling them to evolve, grow and extend the original set of services they first began with rather than investing a lot of cash in new technologies or an army of in-house developers to come up with a prototype in probably what would be months or in some cases a few years with all the risks it brings with it.

Conclusion

With the overwhelmingly exploding figures in the number of Fintech startups being founded in the coming years and the overflow of funds going into them, investors find themselves competing for the ripest and lucrative of investments, and many are realizing cash investments alone does not fulfill the value in quick ROIs and sell-outs, they need to transition into being the strategic investor, with one critical component of the equation, the technology itself upon which these Fintech startups would ensure a higher possibility of growth and success. Investors are seeking technology partners that would provide them this part of the role and learn in the process a different aspect of the game.

About CIT Vericash

CIT VERICASH is a division of CIT GLOBAL, an innovative financial inclusion Software Platform that help enable all kind of Fintechs through the digital transformation of financial services, provision of its agile & scalable technology, deliver its ready regional financial markets network connectivity’s, and its global financial expertise. VERICASH empowers Fintechs to deliver innovative digital financial services to achieve the fastest growth with the maximum flexibility to address all their customers across multiple markets.

CIT GLOBAL, an international leading provider of innovative eCommerce and mCommerce software solutions and services with solid expertise spanning 25 years, since its establishment in Toronto, Canada in 1993. By applying CIT Global’s dedicated centers of excellence and its specialized leading products, in cooperation with its strategic partners, the company has delivered innovative and award-winning solutions to its clients in more than 48 countries, serving leading brands from North America, Europe, Asia Pacific, the Middle East, and Africa.