It is all about the bundling! The convergence of digital financial services

Digital financial services, DFS, the advantage of digital financial services, digital finance service provider, digital transformation, digital financial inclusion, secure digital finance

Over the last five years, Fintech investment and services have experienced steady growth in Africa. In fact, it reached a record high in 2020, with a total net of $23 billion across all regions.

Investors and policymakers have acknowledged the “game-changing” prospect of digital financial services (DFS) inclusion on the international level. These digital financial services have made formal banking services accessible to global audiences, especially underprivileged populations.

In 2014, Jamie Caruana, the General Manager of the Bank for International Settlements, pointed out that soon institutions and state governments would have the opportunity to prepare for the risks and rewards of bundling or the digitalization of these financial services. The range of these financial services includes payments, savings, credit, insurance, and remittances, and are usually delivered by Fintech services.

These Fintechs applied customer segmentation policies to reach out to their target demographics. Instead of limiting themselves to individual customers, they expanded these DFS protocols to corporates, SMEs, and the mass retail market.

The Future Of Bundling In Financial Services

Currencycloud recently performed a study predicting future trends related to bundling in financial services. The study included more than 9000 consumers and 500 businesses spread across nine countries.

According to the final report, almost 95 percent of financial institutions reported that they didn’t notice any disadvantages to bundling to their customers. 88 percent of these companies also claimed that they saw their firms as a one-stop-shop for their consumers as they offered an extensive suite of digitized financial services.

When asked to elaborate on the possible effects of bundling and the advantages of digital financial services, 93 percent of the respondents confirmed that it primarily depended on the convenience of accessing all products in one place. Some consumers also explained that personalizing their user experience saved their time and ensured them increased security from cyberattacks and financial scams.

It is quite evident that the growth of Fintech companies has massively benefited the customers. These companies have been successful in carving out niche markets in specialized financial services such as insurance, round-up investing, savings, loans, etc.

Along with these trends, several African fintech startups are also gaining ground. The big shots include names like OPay, Flutterwave, Tala, Bayport Financial Services, etc. These firms have been able to collect $1.71 billion in funding and are dedicated to solving the most challenging financial problems facing the country.

Fintech experts and consumers in the African subcontinent have realized that these startups have a much more effective shot at bringing financial equality to the nation than traditional banking services.

Overall, the bundling of financial services has provided customers with more choice and agency when making their financial services. Additionally, there has been increased accessibility, especially with the help of mobile banking.

The Split from Traditional Banking

Previously, with traditional banking systems prevalent in Africa, underrepresented groups were at a major disadvantage because of the restrictions placed upon them by the world’s power and trade systems.

According to a report published by the World Bank, there were close to 20 million unbanked individuals concentrated in North Africa. Besides, almost 57 percent of Africans lacked proper registration and bank accounts.

The rise in popularity of Fintechs is partly owed to the fact these companies promised a new financial system that would outstrip traditional oppressive services. Instead, they guaranteed the introduction of an automated system and focused on individualism. Many saw this new wave of financial services as the key to Africa’s economic liberation.

As these Fintech companies continue to grow, they serve large proportions of women users. This wasn’t the case before. Savings and investment startups, in particular, have seen a sharp increase in women users.

The split from traditional banking was first realized when Jumia became the continent’s first-ever billion-dollar tech company in 2016. This indicated a significant amount of untapped potential in the region, making the convergence of digital financial services possible.

This growth was followed by several other Fintech startup unicorns, such as Interswitch and Fawry. These Fintechs partner with corporates to offer as many services to their customers through integration.

Breaking the Banking Cycle

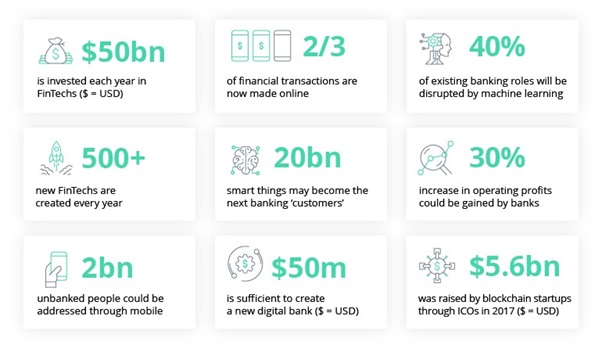

It has become an obvious sight globally that more and more, banks are not the typical go-to-first place should I require a financial service. With a majority of banks still lagging behind when it comes to taking serious steps to restructuring how they operate and how they deliver their financial products to their different customer segments, Fintechs are easily eating up their market shares. And although a multitude of banks are choosing to adopt, partner or acquire a lot of other Fintechs, there is a significant unmet gap in the global financial consumer market.

It comes with no surprise that emerging markets are in the lead for this change, with much younger populations, and the enforcing power of the Gen Z, who are becoming a force to reckon with.

Payments at The Heart

At the heart of any financial services being bundled between different lending, or remittances, or otherwise is to conveniently and affordably be able to conduct all my payments seamlessly with minimal hassles, and would be great if we add instantly on top.

So whether this involves paying for merchandise or services online, making payments to a vendor or supplier or other merchants, or making a payment to a person, digital payments are becoming the dominant form of financial service dominating any expectation in a financial app.

When we are talking about millennials all the way to Gen Z generations, the expectation of bundling all my basic financial services in one application is what really comes out strong and loud. So if one is able to make all their payments, regardless to whom and where, and for what, able to apply for low-risk loans for my personal needs or for my small business, or apply for insurance, voila, that would satisfy a huge young unbanked population across the globe, over 100 million alone in Africa!!

That has led to the creation of the newly formed dubbing of a SuperApp, supposedly an app that offers bundling of different basic financial services plus a how bunch of other added-value services such as ordering takeout food, booking cinema/concert tickets, making travel plans, etc…which are a part of the majority of people’s everyday lives.

The Technology

So again and again, technology agility and its scalability comes at the core of making all the above actually happen. As much as one would assume, with all the different options there from an abundance of tech companies that should be a piece of cake. Well…It’s not.

Besides the technology capability, there needs to be adjoining value pillars that complete the whole scale. Crucial parts are the network to glue all these services together, the expertise of what the market needs and the necessity of easily being able to change business models as businesses evolve, the infrastructure surrounding that, plus the regulatory flexibility to enable all this.

Albeit the serious challenge, there are some serious attempts to bridge or reduce these gaps. CIT VERICASH, a leading regional technology provider across the MEA region, tries to cover as much as possible of these pillars to its different customers, varying from banks creating digital banking platforms to MNOs transitioning into Fintechs, or Fintech startups wanting something extremely nimble and agile to help them go to market and grow exponentially in a limited amount of time.

They offer their digital SW platform that can provide a suite of different financial technology solutions to all different kinds of digital financial service providers but is designed in a manner that easily allows them to manipulate the way in which they want to deliver it, playing around with the different parameters easily regardless how big or small the provider is.

They provide the scalability, especially for Fintech startups to scale their business and the markets they operate in. They provide their network of ready connectivities into existing financial ecosystems such as central payments switches, bill aggregators, or international payment rails through their network of partners to avoid the hassle of providers doing this on their own in addition to enabling them to further stack up on their value-added services.

They provide the operational managed services to absorb the operational pain of managing their own IT environments and provide the necessary best practice consultancy services to help build up on their customer base and transactional uptake.

Conclusion

In today’s dynamic & volatile world of financial services, such examples could facilitate the faster and flexible delivery methods of different types of financial services whether basic or complex. Enabling the easy bundling (or unbundling) of services has become a crucial part of the equation and to easily match changing market demands.

If one thing is for sure, everyone is going back to the drawing board, rethinking how and to whom they want to focus their services. The variations of offering different kinds of financial services to different customers in different markets are becoming more and more like a jigsaw puzzle, trying to figure out how to create different models personalized for each and every segment and market.

About CIT Vericash

CIT VERICASH is a division of CIT GLOBAL, an innovative financial inclusion Software Platform that help enable all kind of Fintechs through the digital transformation of financial services, provision of its agile & scalable technology, deliver its ready regional financial markets network connectivity’s, and its global financial expertise. VERICASH empowers Fintechs to deliver innovative digital financial services to achieve the fastest growth with the maximum flexibility to address all their customers across multiple markets.

CIT GLOBAL, an international leading provider of innovative eCommerce and mCommerce software solutions and services with solid expertise spanning 25 years, since its establishment in Toronto, Canada in 1993. By applying CIT Global’s dedicated centers of excellence and its specialized leading products, in cooperation with its strategic partners, the company has delivered innovative and award-winning solutions to its clients in more than 48 countries, serving leading brands from North America, Europe, Asia Pacific, the Middle East, and Africa.